How Online Transaction Works?

In today’s digital age, the convenience of online transactions has revolutionized the way we handle our finances. Whether it’s purchasing goods, paying bills, or transferring money to a friend, the process of online transactions has become an integral part of our daily lives. But have you ever wondered how money seamlessly flows from one account to another through the virtual world? In this comprehensive guide, we will delve deep into the workings of online transactions, unraveling the complexities and shedding light on the mechanisms that power the digital economy.

What are Online Transactions?

An online transaction refers to the process of electronically moving funds from one account to another over the internet. This could involve purchasing products or services, transferring money between bank accounts, paying bills, or even donating to a charitable cause. These transactions take place through various digital platforms, including online banking portals, mobile apps, e-commerce websites, and payment gateways.

Related Articles

The Step-by-Step Process of an Online Transaction

Step 1 : Initiation

An online transaction begins when a user initiates a payment or fund transfer. This could involve selecting items in an online shopping cart, entering payment details on an e-commerce site, or filling in the necessary information on a payment app.

Step 2: Authentication

Security is paramount in online transactions. Once the transaction is initiated, the user’s identity needs to be verified. This is typically done using authentication methods such as passwords, PINs, biometric scans (like fingerprints or facial recognition), or two-factor authentication (2FA).

Step 3: Encryption

To safeguard sensitive information during transmission, encryption is employed. This process converts the data into a code that can only be deciphered by the recipient. Secure Sockets Layer (SSL) certificates are commonly used to establish encrypted connections.

Step 4 : Transaction Routing

Once authenticated and encrypted, the transaction data is sent to the payment gateway or the financial institution’s server. The payment gateway acts as a bridge between the merchant (seller) and the acquiring bank (merchant’s bank), ensuring the transaction is properly processed.

Step 5 : Authorization

The acquiring bank receives the transaction request and checks whether the user has sufficient funds or credit to complete the transaction. If approved, an authorization code is generated.

Step 6 : Processing

The payment gateway forwards the authorization code to the merchant’s system, which can now process the order or request.

Step 2 : Clearing

The authorized transaction moves to the clearing stage, where funds are transferred from the user’s account to the merchant’s account. This might involve several intermediaries, especially in cross-border transactions.

Step 2 : Settlement

In this final step, the merchant’s acquiring bank sends the funds to the merchant’s account, and the transaction is marked as complete. Settlement might take a few days, depending on the involved parties and the type of transaction.

Conclusion

Online transactions have transformed the way we handle money, offering unparalleled convenience and accessibility. Behind the scenes, a complex and secure process ensures that your funds are transferred safely from one digital pocket to another. By understanding the steps involved and staying vigilant about security, you can make the most of online transactions while safeguarding your financial well-being in the digital age.

FAQs – Frequently Asked Questions

1. Are online transactions safe?

Yes, online transactions are generally safe. Reputable financial institutions and e-commerce platforms implement robust security measures such as encryption, two-factor authentication, and regular security audits to protect users’ sensitive data.

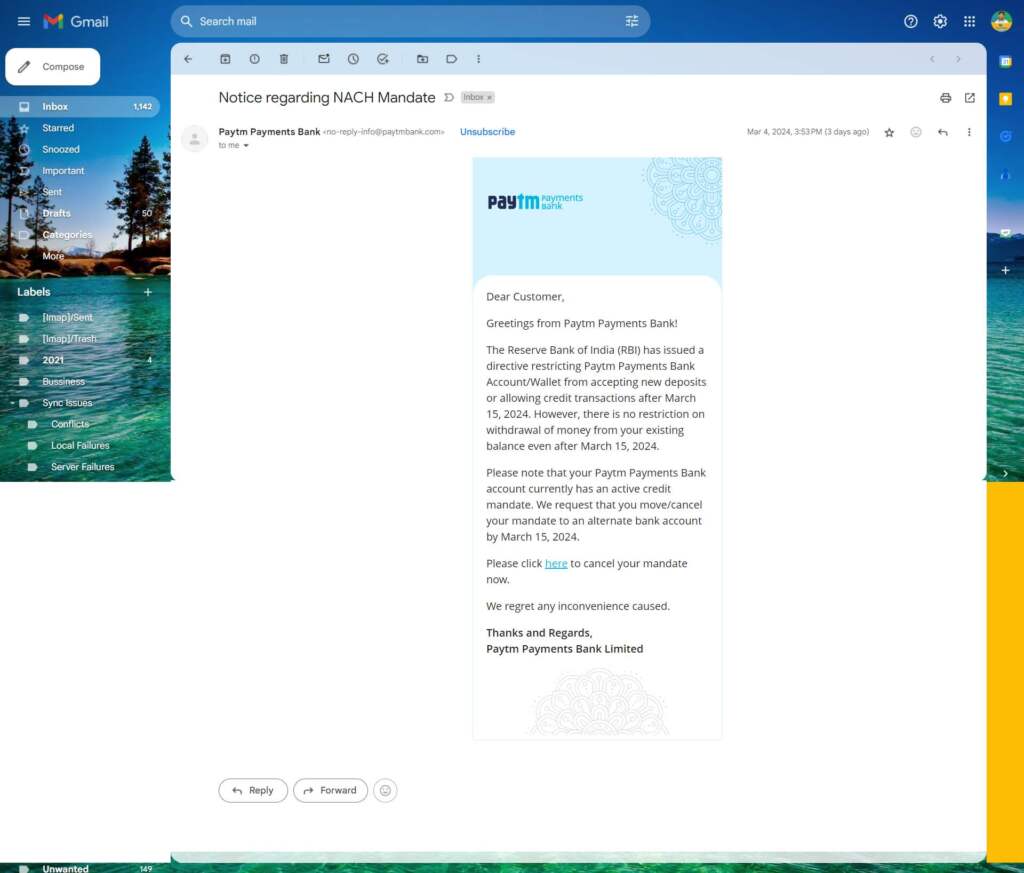

2. What is a payment gateway?

A payment gateway is a technology that facilitates the transfer of transaction data between a merchant’s website and the acquiring bank. It ensures that sensitive data is securely transmitted and helps authorize and process the transaction.

3. How do I know if a website is secure for online transactions?

Look for “https://” in the website’s URL. The “s” stands for secure and indicates that the website is using SSL encryption. Additionally, modern browsers often display a padlock icon next to the URL to signify a secure connection.

4. What is two-factor authentication (2FA)?

Two-factor authentication adds an extra layer of security by requiring users to provide two different forms of verification before accessing an account or making a transaction. This could involve something you know (like a password) and something you have (like a code sent to your phone).

5. Can I reverse an online transaction?

In most cases, online transactions are irreversible. However, some platforms or financial institutions offer dispute resolution mechanisms to address unauthorized or fraudulent transactions.

6. How long does it take for an online transaction to complete?

The time it takes for an online transaction to complete varies. Simple transactions might be processed within seconds, while others, especially involving multiple parties or cross-border transfers, might take a few days.

7. Are there limits on the amount I can transact online?

Yes, there are often transaction limits imposed by banks or payment processors to prevent fraud. These limits can vary depending on your account type and relationship with the institution.

8. Can I use public Wi-Fi for online transactions?

Using public Wi-Fi for online transactions is not recommended, as it poses security risks. Public networks are more susceptible to hackers and cyberattacks. If you must make an online transaction, consider using a virtual private network (VPN) to encrypt your connection.

9. What should I do if I encounter a problem during an online transaction?

If you encounter any issues during an online transaction, such as an error message or unauthorized activity, contact the platform’s customer support or your bank immediately for assistance.

10. Are mobile banking apps secure for online transactions?

Most reputable banking apps are designed with strong security measures to protect your data. Ensure you download apps from official app stores, enable security features like biometric authentication, and regularly update the app to the latest version.